The true story of how I hyperventilated at the car dealership

Yes, I hyperventilate in some big ticket money decisions…like this one.

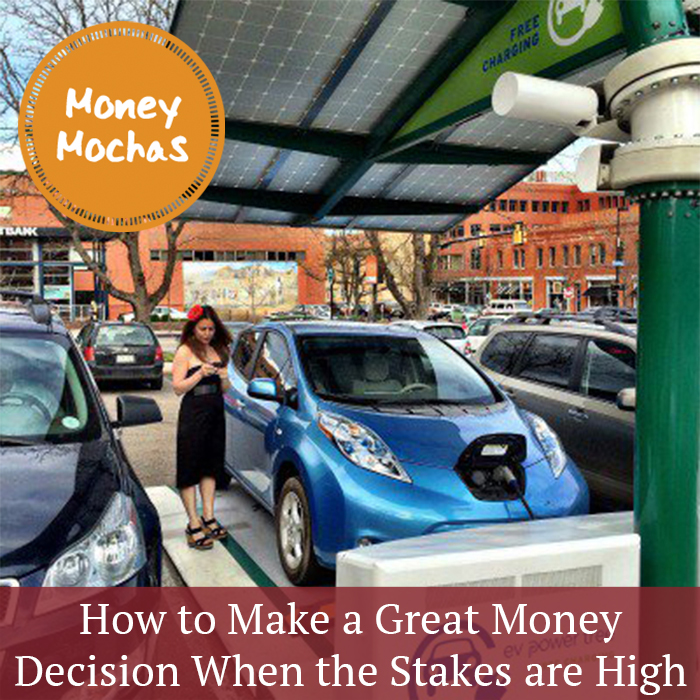

“Good car, good car,” I said, patting the dashboard of our electric Nissan Leaf.

Our little family is so grateful for this car. It reduces our carbon footprint — and shows our son how fun and cool that can be! It gives us tons more freedom than when we only had one car. And it runs like a dream.

But 4 years ago, when we were wondering whether to buy our Leaf, things weren’t so crystal-clear.

Like any money decision, there were a lot of factors to weigh.

After all, it was a big ticket purchase. Did we really want to spend that much money? How could we KNOW it would be a good decision that we wouldn’t regret? And what about the differences between how I like to make money decisions and how Forest (my hubby) approaches them?

Truth: we made this BIG money decision in 20 minutes flat.

This wasn’t an impulse purchase, though! We were able to make this decision quickly thanks to the years we’ve spent working on our money relationships — solo and as a couple.

But we also used a simple, comprehensive framework to weigh all the factors … which we’ve used ever since. It works that well!

Kick back and listen to the true story of how I hyperventilated in the car dealership … and then made a FAB money decision with my hubby that still makes us smile, years later.

You’ll learn:

- The exact framework we used to make a BIG money decision (and have used ever since)

- How Forest and I navigate our VERY different money decision-making styles

- How we weighed our short-term, long-term, and values-based money priorities

- How to de-stress big ticket money decisions (you can do this anywhere!)

Whether you’re facing a big ticket purchase or a smaller one … a solo decision or family-wide affair … I hope this framework helps you get clear on what a good money decision means to YOU, right now.

Nobody can tell you what a good money decision is … except you.

Sure, a financial expert might tell you about interest rates or what the market’s doing or the long-term impact of certain decisions. And all of these can be good and important to consider.

But what about your values? What about your unique gifts and challenges and goals? What about where you are, at this specific moment in the ups and towns of your one precious life?

How you relate to money can incorporate ALL of this. All of YOU.

In fact, when you give yourself permission to bring all of yourself to your money relationship — all of your gifts and smarts and heart and emotions and spirit — things change. Deepen.

Mountains begin to move.

I’m in love with deep money work because it affects every aspect of our lives. This is what I’m on a mission to share with you.

If you’d love to experience this whole-self work, I’d love to be your guide in my beloved, year-long money school, The Art of Money.

There are just a few more days to join in our early registration period (with oodles of tools and help to get you started on changing your relationship with money for the better right now).

Click here to join The Art of Money 2018.

I’d be honored to welcome you to our global community.

P.S. What’s a Money Mocha? It’s a mini-jolt of financial clarity. A drop of money wisdom. A morsel of peace and joy you can access in just a moment … and savor as long as you like.

And it’s a sneak peek of the kinds of teachings you’ll find in my year-long money school: The Art of Money, now open for registration (though early bird registration ends in a couple of days).

The Art of Money 2018 officially kicks off in January. But if you sign up now during our earlybird shindig, you’ll get a boatload of e-prezzies from me, so you can start shifting your money relationship, right now.