Some Money Dates are planned. Others just … happen.

This Saturday night, my husband, Forest, and I suddenly found ourselves smack dab in the middle of a Money Date. It wasn’t planned. And it definitely wasn’t all “sunshine and rainbows.” But we stuck with it, through sobering compromises and unexpected celebrations. And by the end, we found ourselves even closer together.

So … what happened? I’ll tell you the whole story, in a moment. First, I want you to know: this kind of “spontaneous” Money Date is NOT for beginners!

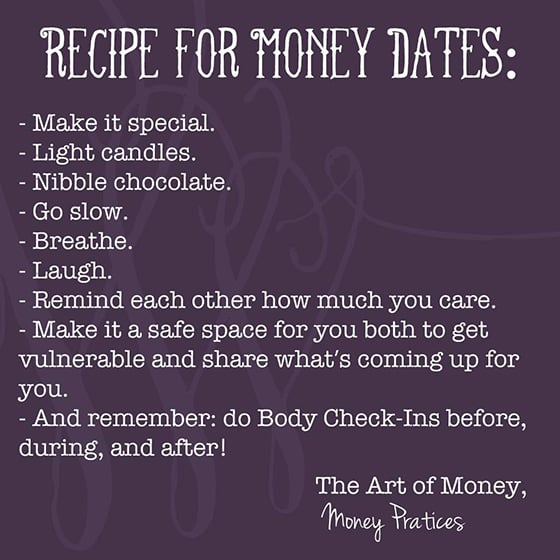

Because money is such emotional, complex, rich territory — especially for couples — I always suggest adding some structure to Money Dates, in the beginning. Loads of safety. Compassionate listening. Body Check-Ins, chocolate, wine — whatever you need to walk through this terrain, together.

Forest and I have baby-stepped our way to this point for years. We have practiced ongoing, structured Money Dates, laying the groundwork that now allows us to have a more spontaneous Money Date, feel safe with each other, and remain compassionate and present.

Check the bottom of this post for two helpful articles to get started having Money Dates with your sweetie.

OK. Disclaimers outta the way. Here’s what happened …

The Scene

It was a quiet family weekend. Our boy, Noah, had a cold, and was resting on the couch, watching How to Train Your Dragon. (Sidenote: such a great movie!)

I’d been feeling a big Money Date a-brewing for some time now. A Money Date to support the big juncture we’re at in our personal and business adventures. A Money Date that was bigger than our off-the-cuff quickie chats — or even our monthly conversations.

It was time for a quarterly Money Date: one where we zoom out to the larger picture, look back over the past few months, and forecast the upcoming few months. One where we evaluate our personal and business cash-flow, how we’re spending our money, what risks we’re willing to take, and whether we need to reign back our spending.

I knew this big Money Date was coming … I just didn’t know it would happen that Saturday night. So, back to the scene …

Forest was at the dining room table, working through some financial spreadsheets. He called me over, and asked if I’d like to see some of the reports he’d created. We began taking an honest look at what we’ve been spending in some of our important categories: business expenses, rent, groceries, our son’s school tuition, and health.

When I realized we had stepped into a full-blown Money Date, I quickly got out my matches, lit a candle, and spritzed some essential oils over our heads.

Forest laughed, and asked, “Shall we add some glitter? Anything else you need before we continue?” He was gently teasing me, but it was also a genuine check-in. You see, these aren’t just details to me: they’re sacred tools that help me set an intention of love, clarity, and compassion during these conversations.

The “Bones”: Reality Check

Since this was a Quarterly Money Date, we did peek at the entire year, but we mostly focused on our numbers for the last few months — and the next few months.

Forest tracks our expenses in iBank these days. It’s a simple system that syncs with our bank, and we love the categories and simple reports. (Sometimes, we use an additional Excel spreadsheet in our Money Dates, but we didn’t need it for this one.)

We pulled the reports from iBank, took a deep breath, and looked at the breakdown of our personal income and expenses, month by month, since January (but focusing on the last quarter). We asked ourselves:

- What was our average monthly income since January?

- What was our average monthly expense since January?

- What has changed?

- What is surprising us?

- What is making us nervous?

- Where is our spending truly in alignment with our values — and where is it not?

We also took a careful look at our business income and expenses since January:

- What is our average recurring income, right now? (Monthly payments from my year-long program, The Art of Money.)

- What additional income just came in? (We recently opened a few spots for my private financial therapy, which has really boosted our cashflow.)

- What additional expenses have popped up? (We grew our team this year in a few ways — both planned and spontaneously.)

The reality was sobering. Especially since we didn’t add wine or chocolate to this Money Date!

After looking at both our personal and business numbers, we took a deep breath, together. It was time for a Body Check-In! We asked ourselves (and each other): how does this all feel?

It was truly a reality check. Sobering. Certainly not the most fun, celebratory Money Date … but a really good one.

Then, we mapped out the next five months of our business and personal cash-flow together. It was wonderful to let it sink in: all of our needs will be accounted for, and we’re doing very well. And, still have a lot of room to grow (in money and in life!)

We decided we wanted to reign in a few of our spending categories to make some bigger dreams possible. Simply being aware of what we had spent in the last few months made it so much easier to identify where we wanted to cut back spending, and what categories were “non-negotiable.”

From Forest:

Together, we mapped out the next 5 months, and what fog remained on the trail ahead cleared up in that hour of discussion and looking and forecasting. The more we looked, the closer we became together. There was a palpable feeling of being on an expedition together, and the planning we were doing was vital for the months ahead on the journey.

Our Game Plan

So, we needed to reign in some spending. We weren’t in “Maximum Lockdown Mode” (a playful term we used years ago, when we needed to survive a cash-flow dip), but it was time to decide what expenses were up for negotiation, and which weren’t.

Thus began a little dance of suggesting and compromising. Forest proposed not dining out so much. (But this is one of my favorite things to do on our personal and working dates!) So, we decided not to eliminate restaurants, entirely, but to cut back for the next few months. We even came up with a beautiful compromise: for our “working dates,” we will forgo the expensive restaurant meal, and instead meet at our favorite coffeeshop, over a glass of wine.

Our game plan:

- Cut back on restaurant spending for the next few months.

- We found a “money leak” in Forest’s business, and came up with a great tech tool to save us $200 each month.

- We recommitted to our BIG Fall business adventure (I can’t wait to tell you all about it!)

Just as importantly, we celebrated all that we’ve accomplished this past year:

- We have a nice, recurring monthly income from my year-long program

- We added in additional services (my private financial therapy) to support our increased expenses (ie: growing our team).

- We grew our internal business team in a significant way. YAY Team!

- We paid down our business debt

- Even though we still have a lot of room to grow towards accomplishing our long term savings goals, we also didn’t dip into our current savings cushion (which we thought we would need to do this year)

- It was our best biz year, yet.

Let me repeat that: we celebrated.

It would have been so easy to forget to celebrate, since this was a sobering Money Date. And that’s why it was so important that we celebrated!

Some Money Dates are sexy and exciting and fun — and it’s easy to celebrate during these! But for this Money Date, we found ourselves facing a lot of unknowns. Looking up at a big mountain we’re about to climb. (The creative entrepreneur life is such an adventure!). We got some clear reminders of where we still need to work and grow, like next level savings and retirement.

While we certainly want to tighten our belts a bit, we also have so much to be grateful for: our home in Boulder, our son’s Montessori education, and co-creating this business we love.

Take the time to celebrate.

Especially when things get tough.

I’m so grateful that we looked back and honored everything we had accomplished together, this year. This balanced-out the sobering, challenging quality of this Money Date … and made us feel like we had regrouped, recommitted, and locked arms to climb the mountain together.

From Forest, again:

The feeling of togetherness and connection that I felt by the end of the money meeting was beautiful. It lasted throughout the rest of the day. It’s a kind of intimacy that’s hard to get any other way. The mixture of love, awareness, and feeling like we’re on the same team is so beautiful.

Understanding where we are is essential as we continue this journey, together. And this is the beauty of a great Money Date, folks. It offers us the awareness we need to stay on track with our goals and values — even when these need to shift.

So … stay tuned! We’ve got some exciting things to share with you, over the next few months: the opening of the Art of Money 2015 (my year-long Money School), an incredible Art of Money Symposium with Entheos … and so much more.

We’re so grateful to share this adventure with all of you!

Love this? Have your own Money Date with your sweetheart! Here’s help:

Ten Ways to Deepen Your Connection with your Honey through Money

Money Love with Your Honey: Four Phases + My Best Tips

What to do if a Money Date with your Honey Sounds HORRIFYING